industrialprocesswater |

|

The European market for high-quality water treatment equipment perks up in response to intensifying demand amongst industrial end-users for increasingly pure water for their manufacturing procedures. Although individual segments are more advanced in terms of product lifecycle than others, the European industrial process water treatment equipment market is heading for a period of steady growth and continues to offer market participants an abundance of opportunities for profitable market exploitation.

The ongoing pursuit of reducing running costs and guaranteeing an optimal quality/quantity ratio has led industrial end-users to increase installations of technologically-advanced equipment for the treatment of water utilised in on-site processes.

In the wake of plummeting equipment prices, industrial end-users are becoming more involved in the installation and exploitation of their own bore holes for water supply as well as their own wastewater treatment plants, observes a new study by Frost & Sullivan, the international marketing consulting company.

"As the cost of municipal water supply rises, we expect interest in process water treatment equipment from the industrial sector to expand," says Matthew Barker, Industry Analyst at Frost & Sullivan. "A lot of the work that is currently being carried out is still at the consultancy stage, as companies are weighing up the economic viability and efficiency of installing their own high quality process water treatment equipment," he continues.

The growing eminence of ultrapure water as a standard requirement, coupled with the industry's move towards abstracting its own water supply and the shift from chemical to physical treatments will help push revenues from $450.1 million in 2000 to $770.6 million in 2007.

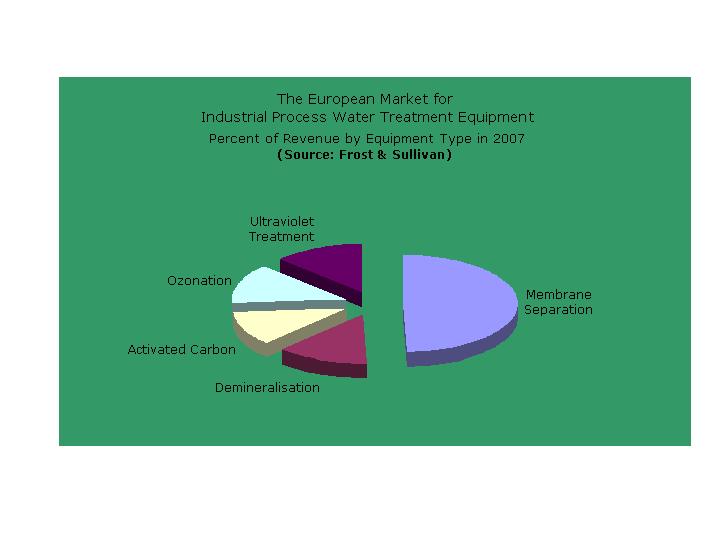

Demineralisation and activated carbon have advanced to become fairly established process water treatment methods. Relatively new techniques such as membranes, UV and ozonation are expected to enjoy prolonged strong growth in this sector up to and beyond the forecast period.

In its review of national markets, the study confirms Germany's continued dominance in the European water sector. However, over the forecast period, the German share of the overall market is expected to decline due to the nation's increasing saturation of process equipment market.

The UK follows in second position, predicted to exhibit the most impressive growth over the forecast period. "Bright growth prospects are forecast for France and Iberia on the strength of the countries' developing industrial bases and growing awareness of the equipment's capabilities. Meanwhile, sales growth across all other national markets will start to decelerate as intensifying market maturity will hamper investment. New developments and retrofitting, however, will breathe new life into these national markets," Barker adds.

The membrane separation systems sector will retain its unassailable spearheading position over the forecast period and continue to eclipse demand across the other sectors under review in Frost & Sullivan's study.

The buoyancy of this market can be ascribed to a number of factors, most importantly the fall in equipment prices and the growing acceptance of membrane products. The rise in quality reference plants now in operation in the industrial sector will provide further impetus for growth.

The European demineralisation market for industrial process water treatment equipment has reached maturity, but still achieves fairly good year-on-year growth. However, the emergence of more environmentally friendly and versatile technologies towards the end of the decade will lead to flagging sales in this sector.

Both ozonation and ultraviolet equipment will gain in popularity as the number of applications rises and equipment prices plummet over the forecast period while the two more mature technologies of demineralisation and activated carbon equipment will both take a nosedive over the next six years.

Arantxa Mencia, joint author of the study, highlights the food sector's strong demand for clean process water and substantial volumes of high purity water additives. "The assurance of ultrapure water is particularly crucial in this marketplace, along with the brewing industry. Consequently, these process water treatment technologies will increase in importance, aided by the move away from chlorinated water." Other key end-users highlighted in the report include the microelectronics, pharmaceutical and chemicals industries, all of whom will continue to be key customers over the coming decade.

Around 200 to 250 companies are currently active in the European market for industrial process water treatment equipment, ranging from huge multinational turnkey plant suppliers to specialist manufacturers. The leading three contenders - Vivendi Water Systems, Ondeo Degrémont and the BWT Group - account for a combined 21.8 per cent share of the total market.

The European Market for Industrial Process Water Treatment Equipment

A New Study By Frost & Sullivan

Report Code: 3964, Publication Date: July 2001

For further press information, please contact Frost & Sullivan's Public Relations Department

Tel. +44 (0) 20 7343 8376 or kristina.menzefricke@fs-europe.com